This post was written to reflect the 2023 tax year. If you prefer to listen, check out this podcast episode by clicking here.

As an optometric practice owner, you know that there are many benefits to owning your own practice. Freedom and control over your business and patient experience. More control over your time. And many financial benefits and planning opportunities. Among the many benefits are the tax planning opportunities of business ownership.

One of the most significant tax planning opportunities for business owners is the QBI (Qualified Business Income) deduction. This deduction can reduce your taxable income in a big way and help you keep more money in your pocket.

Despite its complexity, understanding the QBI deduction is crucial for optometrist practice owners who want to take advantage of this tax benefit. In this blog post, we’ll revisit the background of the QBI/199A deduction, how it works, limitations and phaseouts, and planning opportunities you should consider. Whether you’re new to the QBI deduction or need a refresher, let’s dive in and learn more.

What’s the Background of the QBI/199A Deduction?

The QBI deduction was introduced with the Tax Cuts and Jobs Act (TCJA) of 2017 to balance against the flat 21% corporate tax rate.

It’s specifically for pass-through businesses:

- Sole proprietors

- LLCs not taxed as C-corporations

- S-corporations

- Partnerships.

Essentially, anything that’s not a C-corporation. Practice owners, independent contractors, and optometrists with side-businesses can all benefit from it.

The QBI deduction allows eligible taxpayers to deduct up to 20% of their “qualified business income” from their taxable income. This deduction can result in significant tax savings for optometry practices and other small businesses.

It’s set to expire – or sunset – at the end of 2025. So, unless Congress extends the deduction, our planning window is at least over these next 3 tax years.

What is “Qualified Business Income”?

Technically, “qualified business income” (QBI) is the net amount of qualified items of income, gain, deduction, and loss for a qualified trade or business. In plain English, it’s your taxable business profit (with a few adjustments).

By default, it’s calculated separately for each business you own. It’s specifically for profit from the operations of your practice. It does not include non-profit income that’s generated from or in your business. For example, QBI eligible for the deduction does not include:

- Capital gains, investment dividends, and interest,

- Reasonable compensation for S-corp owners, or salary and wages

- Guaranteed payments in a partnership, or payments to partners for services rendered.

Any business deduction you take to lower taxable business profit – like depreciation – will also lower QBI.

You’ll find QBI/business profit on your Schedule C or Form K-1s, and use that to calculate the deduction.

“Self-employed” optometrists have to make a few adjustments to find their QBI eligible for the deduction. You’re considered self-employed if you own a sole proprietorship, LLC not taxed as a corporation, or a partnership.

Start with your business net income, then subtract out certain deductions/adjustments, such as:

- Pre-tax self-employed retirement plan contributions such as SEP IRAs or Solo-401(k)s

- The deductible ½ of your self-employment taxes

- Self-employed health insurance deductions

After you subtract those out, that’s what’s considered “QBI” eligible for the 20% deduction, lowering the deduction.

Example 1

Jordan is an independent contractor. He is simply a sole proprietorship and his net income is $160,000. As a self-employed business owner, he gets to take a deduction for half of his self-employment taxes, which would be $11,303. He also contributed $5,000 pre-tax to his solo-401(k).

His QBI for the deduction would be:

-

- $160,000

-$11,303 deductible half of self-employment tax

-$5,000 pre-tax solo-401(k) contribution

= $143,697 Qualified Business Income

- $160,000

His potential QBI deduction would be $28,739 ($143,697 x 20%).

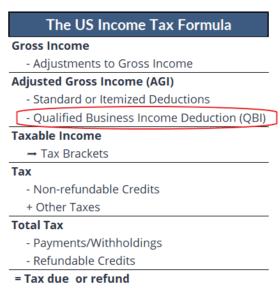

Where Do You Find the QBI Deduction On Your Tax Return?

The QBI deduction is found on Line 13 on 1040, just below Standard or Itemized deductions.

It’s after the Adjusted Gross Income (AGI) is calculated and unfortunately doesn’t help lower your AGI, which is often used to determine whether you’re eligible for many deductions, credits, additional taxes, IRA contributions, and other tax issues.

You’re able to take it regardless of whether you take the standard deduction or itemize deductions.

How Do You Phase Out of the QBI Deduction?

The first limitation is that your QBI deduction is the lower of:

- 20% of Qualified Business Income, or

- 20% of your Taxable Income – before the deduction and minus capital gains and qualified dividends.

You may see this come into play if your practice income is your household’s primary source of income. By definition, taxable income is all of your income minus a few layers of deductions.

Example 2

Jordan is back! His self-employment income is the only income between him and his wife. His net income is still $160,000. His taxable income is:

- $160,000 net income

-$11,303 deductible half of self-employment tax

-$ 5,000 pre-tax Solo 401(k) contribution

-$27,700 standard deduction

= $115,997 taxable income

Jordan’s QBI is $143,697 from Example 1. His taxable income is lower than that, so his QBI deduction would be 20% of his taxable income, equaling $23,199 ($115,997 x 20%).

Example 3

Jim and Pam are married. Pam owns a private practice, taxed as an S-corporation, and Jim is a salesman at a paper company. Pam pays herself a $140,000 salary after 401(k) contributions, and her net profit is $100,000. Jim earns $100,000 after 401(k) contributions.

- $240,000 total wages

+$100,000 business profit

-$27,700 standard deduction

= $312,300 taxable income

Pam’s QBI is her practice profit of $100,000, which is lower than their taxable income. So, her QBI deduction is 20% of QBI, or $20,000.

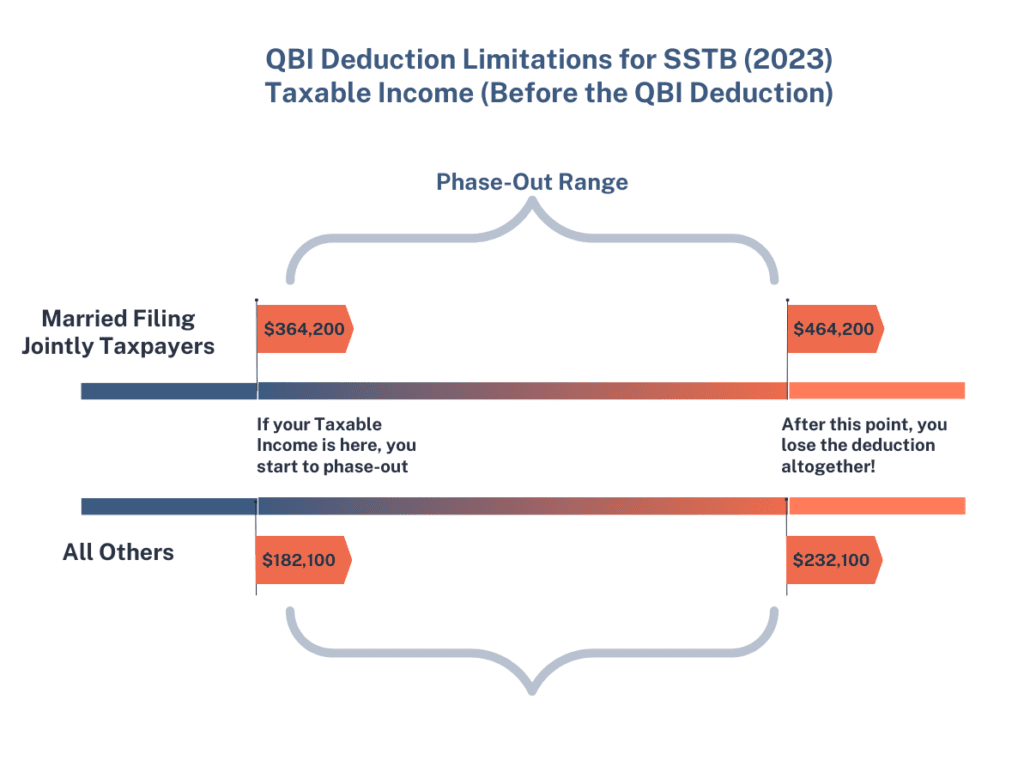

The next limitation is when your taxable income (before the deduction) hits a certain threshold. At a certain point, the deduction begins to phase out. Once it hits a higher amount, as a “specified service trade or business”, you lose the deduction altogether.

For 2023, the phaseout ranges are:

The lower threshold lines up with the 32% marginal tax bracket.

If you are below the initial numbers, then you enjoy the full deduction.

If you are within the phaseout range, it gets a bit complicated. Your QBI deduction is reduced based on 1) how far your taxable income gets into that range, and 2) the amount of total wages you’re paying in your business and the basis of certain business property. I’ll spare you the math on this.

If your taxable income is above the top of the range, as a specified service business, you lose the deduction altogether.

It’s calculated on your individual tax return. So, for practices with multiple owners, it’s possible some owners may qualify while others don’t.

What Are Planning Considerations for the QBI Deduction?

Watch Your Taxable Income

Unlike other tax items based on your AGI, the determining factor for QBI is your taxable income. So, that’s what you need to keep an eye on.

If you’re under the phaseout threshold, enjoy the deduction.

If you are within the phaseout range or are above it, a primary goal is to lower your taxable income to increase – or become eligible for – the deduction. For example:

- Business deductions, like planned equipment purchases or leasehold improvements.

- Deferring income through 401ks, profit sharing, or cash balance pension plans

- Itemized deductions like bunched charitable giving

- Cost segregation studies to increase depreciation on rental properties, especially short-term rentals.

This is an area where deductions can have a bigger impact than just your marginal tax rate. They may not only save you 24%-32% tax on that income, but also may increase the QBI deduction and potentially lower other taxes like the Net Investment Income tax or additional Medicare tax.

Evaluate entity structure

The QBI deduction is calculated differently for different types of businesses.

Sole proprietors and single-owner LLCs filing taxes with a Schedule C can use their full net income from self-employment for the deduction, minus adjustments mentioned above. The tradeoff is that it’s also subject to self-employment taxes.

Partnerships (and LLCs taxed as partnerships) are similar, with each partner’s share of partnership profit used for the deduction. However, this does not include guaranteed payments to partners. If your operating agreement relies heavily on guaranteed payments to balance work between partners, it may make sense to talk with your tax and legal professionals about that.

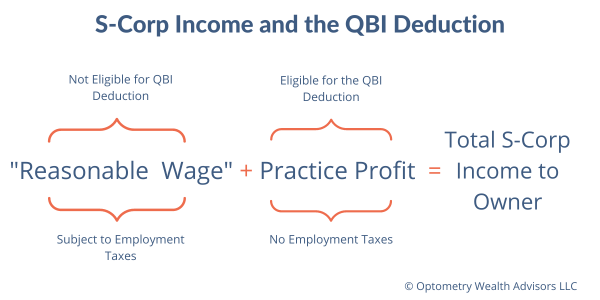

LLCs or corporations taxed as S-corporations are where it gets interesting. In this type of business, you receive income in two ways:

- Required “reasonable” salary as an employee-owner, then

- Distributions of profit from the business

A benefit of S-corp taxation is that only your wages are subject to employment taxes. Your profit is not. So, you save potentially 15.3% of tax on the business profit above your salary.

However, this impacts the QBI deduction. Only your taxable S-corp profit is eligible for the QBI deduction – your salary is not.

This is important for independent contractors to consider, as you’re often advised to open an LLC and choose S-corp taxation to save on self-employment taxes. You should balance the effect on the QBI deduction, as well as the other costs and headaches of operating the S-corp like paying a required reasonable salary, payroll, extra tax return, etc. There are many factors to balance.

For example, if you’re a sole proprietor earning a net income of $160,000, that’s all considered for the QBI deduction. It’s also fair game for self-employment taxes.

You decide to open an LLC and be taxed as an S-corp. Your salary is $130,000. Only your “profit” of $30,000 is eligible for the QBI deduction, while only the salary faces employment taxes.

So, while taxes are only one consideration to deciding which business entity is best for you, the QBI deduction is an important part of that. At least through 2025!

Watch Your Reasonable Salary

Own an S-Corp? You are heavily incentivized to pay yourself a low salary to increase your QBI deduction and lower your self-employment taxes.

Be careful. You have a requirement to pay yourself a reasonable wage for the work you do in the business, both as an optometrist and for management work.

Also consider other factors like how you handle cash flow into your household, how much credit you should build toward Social Security, the impact on profit sharing or cash balance plan calculations, other state/local benefits impacted by your wage like disability or paid family leave.

When calculating a reasonable salary, talk with your tax professional about how fringe benefits like health or dental insurance factor into that calculation. Certain fringe benefits may be included in an S-corp owner’s taxable compensation but are not subject to Social Security or Medicare taxes.

Watch Out For The Retirement Account Impact

Your retirement contributions can impact the QBI calculation in unexpected ways.

As mentioned above, “self-employed” optometrists have to adjust your qualified business income before calculating the 20% deduction.

Your pre-tax retirement contributions are one of those adjustments, and will lower your QBI deduction. This is an important planning point. In effect, you are getting a partial deduction for your contributions. But when withdrawn in retirement, you are taxed on every dollar.

Example 4

Jordan is back again! His net income is still $160,000. His taxable income is:

- $160,000 net income

-$11,303 deductible half of self-employment tax

-$ 5,000 pre-tax Solo 401(k) contribution

-$27,700 standard deduction

= $115,997 taxable income

From Example 2, his QBI deduction would be 20% of his taxable income, equaling $23,199 ($115,997 x 20%).

However, what if Jordan decided NOT to do a pre-tax Solo-401(k) contribution? Instead, he used a Roth contribution, which he doesn’t need to subtract from his net income when calculating QBI. His QBI deduction would be:

- $160,000 net income

-$11,303 deductible half of self-employment tax

-$27,700 standard deduction

= $120,997 taxable income

QBI Deduction = $24,199 ($120,997 x 20%) – $1,000 higher than above.

In this scenario, we see that Jordan’s pre-tax contribution cost him $1,000 of deduction with a lower QBI. But he received a $5,000 deduction for the pre-tax Solo 401(k) contribution. The net total deductions are $4,000, which effectively means only 80% of his $5,000 contribution was deductible. When he withdraws the $5,000 in retirement, the full amount is taxable.

All things considered, it still may make sense to use pre-tax contributions. However, Roth-type contributions may start to make sense at higher income levels than expected. If you have a W2 salary from other work as an employee, you may want to focus your 401(k) contributions there first to preserve the QBI deduction.

S-corporations can see a similar impact. While your employee contributions through payroll don’t impact the QBI calculations, profit sharing contributions do.

Profit sharing contributions lower your taxable net income (it’s a deduction), which lowers your amount of QBI, which lowers your QBI deduction.

Keep this in mind as a factor in the year-end discussion of whether it makes sense to use profit sharing or simply build up a taxable investment account.

However, if you are phasing out because your taxable income is too high, pre-tax retirement plan contributions can lower your taxable income and increase the QBI deduction you are eligible for.

Consult with a tax professional

Did I mention this was pretty complicated? It’s pretty complicated. Perhaps the biggest point here is to talk with your own tax and financial professionals. Don’t just take my word for it. Good, personalized guidance and advice from trained professionals are well worth the investment.

Ah! You made it to the end. Hopefully, this helps you get a better understanding of the QBI deduction. Like anything else, the more proactively you can plan and work with your professionals, the more you can take advantage of it.

Want to learn more? Check out my podcast episode on the QBI deduction, or pick out a time to have a conversation about what’s on your mind financially.

Not quite ready to chat? I’m offering a free financial health assessment to my optometry readers. Click here to get your FREE assessment, take a few minutes to fill out your scorecard, and I’ll send you a free video assessment of your finances.

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC