- The Optometry Money Podcast Ep. 74: Student Loan Planning for Optometrists in 2023 and Beyond

- The Optometry Money Podcast Ep. 67: The Supreme Court Ruling, New SAVE IDR Plan, and Other Big Student Loan Updates

- The Optometry Money Podcast Ep. 62: Payments Restarting and Other Student Loan Updates!

It’s finally arrived! The announcement we’ve been waiting for.

Just in the nick of time, President Biden recently announced big news about federal student loan forgiveness, the payment freeze, and a new income-based repayment plan.

There’s a lot to cover, so let’s dive into what we know right now and how it impacts optometrists. We’ll also have a few Planning Notes where there’s planning to be had.

Payment and Interest Forbearance

This is the easy part. Biden extended the freeze/forbearance on payments and interest for federal student loans “one final time” through Dec 31st. You should expect to start payments again in Jan 2023.

Will it actually be the “final” time? Haven’t we heard that before? They seem to be emphasizing that this round is the last time, and with all the other announcements, it seems that’s likely the case.

What will your payments be when they restart?

The StudentAid.gov website says:

If you’re on a traditional repayment plan, such as a Standard, Graduated, or Extended Repayment Plan, then your loan servicer may recalculate your payment amount when the payment pause ends. Your loan servicer would base your new payment amount on:

- your current balance of principal and interest and

- your remaining repayment period.

If you’re on an IDR plan, your payment amount will return to what it was before your payments were paused (unless you’ve recertified or switched plans since the payment pause began).

So, standard repayment plans may recalculate if you’ve made payments during the freeze. If you didn’t your payment schedule should continue on from where it left off in March, 2020.

If you’re on an income-driven repayment plan, you’re required to recertify your income and family size each year. This determines the payment for the next twelve months.

Your IDR payment will be the same from where you left off. The next time you’ll have to recertify your income won’t be until at the earliest July 2023. If your usual recertification date is scheduled to be between now and July 2023, it’ll be pushed out another year. You may not have to show your income until 2024!

*Planning Notes*:

- The freeze gives you more time to work through a “should-I-refinance-or-not” decision or simply wait to see what comes through the rest of the year.

- From a basic cash flow standpoint, it may have been a while since you’ve had to make loan payments. Take a look at your monthly cash flow, and make sure you’re prepared for that expense to find its way back into your life.

- If you were planning to pay into principal during the freeze but prefer to hold on to your cash, consider “paying” the amount into a savings account. You can make a lump-sum payment as the freeze ends.

- If you’re on an IDR plan, there may also be opportunities around the recertification date. If your income was lower in your last certification (maybe from 2019’s income!) than it will be in 2023-2024, you will likely want to ride out delay until you’re forced to recertify.

- If your income dropped since then, you may actually want to recertify early if lowering your IDR payments makes sense for your overall loan payoff plan.

Loan Forgiveness

As expected, Biden announced loan cancellation plans for federal loans held with the Department of Ed. This includes graduate loans and Parent PLUS loans.

How much is the forgiveness?

Up to $20,000 of cancellation if you got the Pell grant in college, $10k if you did not.

The Administration is using the Pell Grant as a barometer of need.

How do you know if you got the Pell grant? You can sign into StudentAid.gov and the My Aid section should be on the Dashboard when you login. It will show you the grants received in college.

It appears that if you received any amount of Pell Grant, you’re eligible for the higher amount.

Who is eligible for loan forgiveness?

There’s an income limit. Borrowers with income less than $125,000 if single, or $250,000 if married. A press release by the Department of Education says the $250,000 income limit applies to Head of Household tax filers too.

What if you filed taxes as married filing single? You may have done this if you’re on an IDR plan and you’re going for a type of forgiveness. My assumption is that you’ll be under the $125,000 limit.

What type of income if counted for loan forgiveness?

The loan forgiveness is based on Adjusted Gross Income (AGI), which is also where income-driven repayment plans start when calculating payments.

You can find your AGI by looking at line 11 of your 2021 tax return:

What year’s income is considered for loan forgiveness?

Forgiveness will be based either on 2020 or 2021’s income.

Unfortunately, this appears to be a hard cliff. If you are over by a dollar, you’re ineligible.

Fortunately, it seems that you only need to qualify based on one of those years, not both. So, if you had $251,000 of income in 2021, but $249,999 in 2020, you should qualify.

Current students are eligible too! As long as the loans originated before July 1st.

If you’re considered a dependent student based on the Department of Education’s definition, you’ll need to qualify based on your parents’ income.

How do you get Biden’s loan forgiveness?

Some borrowers will get this automatically if the Dept of Ed has your income information.

Borrowers on income-driven repayment plans need to recertify their income each year with the Dep of Ed. But many haven’t had to since 2019.

For all other borrowers, you can apply online through the Department of Ed’s online application until December 31st, 2023. It’s a pretty quick application that doesn’t require any documentation.

Will the loan cancellation be taxed?

Thanks to last year’s ARP Act, the loan cancellation is tax free from federal taxes.

State taxes? Maybe. State taxation is a different ballgame. Some states have no income tax, and others conform closely to federal rules. Others don’t and may tax the amount of debt that’s forgiven.

The College Investor has a cool article about which states do, don’t, or might match federal rules on forgiveness. It’s also possible states will pass legislation to make this loan forgiveness tax free, even if temporary.

What if you made payments during the payment freeze?

If you qualify and have been making payments over the last two years during the freeze, you can request a full refund of any payments made on Direct federal student loans since March 13, 2020. From a recent update to the Student Aid website, it appears you’ll receive an *automatic* refund if you apply and receive forgiveness and your payments brought your balance below the amount you’re eligible for. In this case, you won’t have to deal with the servicer!

What if you paid your loans off completely? It appears you can reach out to your servicer and ask for a refund. Identify which payments you’d like refunded, and contact your servicer with proof of payment to get this started.

What if you refinanced your loans to a private lender? It’s likely that the refinanced loans are not eligible for forgiveness. The Student Aid FAQs says specifically refinanced loans are not eligible.

However, if you made payments to federal loans after March 2020 and THEN refinanced your loans, you can likely call your servicer and ask for a refund of those federal loan payments. It should work the same as if you paid off your loans entirely.

What if you have FFEL Loans? Do you qualify for forgiveness?

Federal Family Education Loans (FFEL) are loans owned by private lenders but backed by the federal government. This program was discontinued in 2007, and any federal loans after are Direct loans.

The Department of Ed’s StudentAid website originally showed that FFEL loans can be eligible for forgiveness if they were first consolidated into Direct federal loans.

However, in a pretty surprising change, the Department now states that if you still have FFEL loans on or after September 29, 2022, those loans are not eligible for this forgiveness program. If you applied to consolidate before the 29th, those loans will still be eligible.

Why? It’s unclear, but all indications seem to point to protecting the forgiveness program from legal challenges by private lenders holding FFEL loans. It’s unfortunate FFEL borrowers – even if a small percentage of ODs – can’t get this relief.

*Planning Notes / FAQs*:

- There’s been some commentary that it’s likely this forgiveness will be challenged in court. The key question is whether the President has the authority to cancel the loans, instead of Congress. While the logic makes sense, it would add a huge question mark for borrowers. Who knows how long that would take, or what the result would be? It may take some time to see this fully play out.

- There isn’t too much planning from an income standpoint to qualify. What your income was in 2020/21, it was.

- If you DID extend 2021’s tax return and you own a practice or are an independent contractor, there may be some room to work here. Extending your tax return extends the filing deadline for your personal tax return to October. If your practice is taxed as an S-corp, it has a separate deadline in September. In that case, there may be opportunities to increase employer contributions to retirement accounts and get under the threshold. Talk with your professional team and see what’s possible.

- If the income limit for single filers also applies to married filing separately, you may want to consider whether it makes sense to file separate tax returns in 2021. If the forgiveness is higher than an extra tax and other filing costs, it could be a net win. If this IS the case, what if you filed an extension but already filed a married joint return? Talk with your preparer about whether to file a superceding tax return. This supersedes the other return you filed if done before the extended deadline.

- If you’re in the middle of refinancing your loans and are eligible for this, you may want to keep $10k-20k of debt inside the federal student loan system.

New Income Driven Repayment Plan

Biden announced yet another – sixth! – income driven repayment plan.

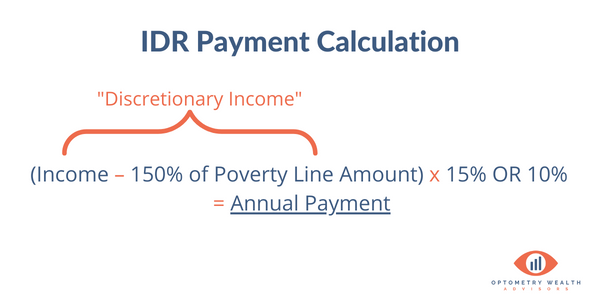

IDR plans calculate payments based on your income, instead of your loan size and interest rates. You take a percentage of your “discretionary income” to find your annual payment.

Depending on which plan you use, the general formula is:

The Poverty Line amount is based on the HHS Poverty Guideline, depending on your state and family size.

Old IBR uses 15% of discretionary income. New IBR, PAYE, and REPAYE use 10%.

How are payments calculated in the New IDR plan?

The new IDR plan will subtract 225% of the Poverty Line Amount from your income, instead of 150%.

It also changes the percentage used to calculate the payment. Undergrad loan payments will be 5% of discretionary income. Graduate loans seem likely to stay at 10%.

It’s not one or the other. If you have BOTH graduate and undergrad loans, there’s a weighted average calculation to figure the percentage rate.

So, the formula may look similar to:

“New IDR” Annual Payment = (Income – 225% of Poverty Line Amount) x (5% or 10%)

How would a weighted average look? For example, let’s say you earn $140,000, and the poverty guideline is $13,590. 60% of your loans were graduate loans, and 40% were undergrad. The formula may look like:

Annual payment = ($140,000 – $30,577) x (60% x 10% + 40% x 5%)

Annual Payment = $109,423 x 8%

Annaul Payment = $8,753

Unpaid interest will be paid by the government as long as payments are made on time. So, there won’t be accruing interest above what’s not covered by your payment.

This is already partially available, but not 100%. For example, REPAYE waives 50% of unpaid interest, and 100% of unpaid interest on subsidized loans for the first three years.

It should also help with preventing capitalizing interest – where your accumulated unpaid interest is added to your principal. This happens after certain triggers, for example, forgetting to recertify your income or changing payment plans.

How long do you make payments until forgiveness?

The new plan should require 20 years of payments until forgiveness.

However, if your original federal debt was $12,000 or less, you’ll only need to pay for 10 years.

Lastly, you’ll have the option to allow the Dept. of Ed to automatically bring in your income to recertify each year, instead of doing it manually. This can take the burden off of you each year when there’s no major change in income or family size.

There are still a lot of unknowns here. Some questions we’re still asking:

- Who is eligible?

- What types of loans are eligible?

- How will married couples that are both on IDR plans be handled?

- Can married couples file taxes separately and exclude the other spouse to calculate payments?

We’ll wait on proposed regulations in the coming days to give us more info on this, and it will likely go into effect 2023.

*Planning notes*:

- This may not move the needle one way or another for ODs deciding whether to fully pay down loans or go for forgiveness.

- However, it will help those that would already go for forgiveness based on federal loan amount compared to income, along with other factors. Lower payments and less accruing interest means a lower tax bomb in the year of forgiveness.

- We’ll need to wait and see who is eligible. Other IDR plans have started with new borrowers at future dates. It’s possible borrowers that aren’t eligible for PAYE (took loans before 10/2007) are eligible for this better payment plan.

Public Service Loan Forgiveness

Unfortunately, the Administration didn’t take steps to extend the PSLF waiver. The limited waiver provides credit toward PSLF forgiveness for past payments that were not considered “eligible payments” while you were working full-time for a nonprofit or government employer.

If Public Service Loan Forgiveness is in the cards for you, you’ll still need to take action by October 31st, 2022. That could include consolidating FFEL loans, filing employer certification forms for any months you worked at a qualifying job starting October 2007, and/or applying for the waiver.

A quirk in this is that all borrowers going for PSLF will now have a new servicer – MOHELA – as FedLoan is getting out of the student loan business. Once the transfers to MOHELA are done, you should confirm your monthly payment counts are accurate.

However, Biden’s announcement included plans to make some of the fixes in the limited waiver permanent for future payments. Essentially, working to improve the program so it works as intended.

Conclusion

Welp, that’s the story so far! There are some opportunities for borrowers to have a good chunk of their debt cancelled and what seems to be a more favorable IDR plan for borrowers going for forgiveness.

Ultimately, this shouldn’t dramatically change your long-term payoff strategy. Your long-term plan should still be determined by the amount of federal loans vs. your income, career goals, marriage and spouse’s federal debt, your values toward debt, and other factors. If you’ve already refinanced and paid off your loans, feel great about having done so and removed them from your life.

There is a heaping pile of questions that needs answers, so I’ll be updating this as we hear more.

Feel free to reach out, follow along with my podcast, sign up for my weekly newsletter (below), or schedule a time to chat if you have any questions.

Happy student loan planning!

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC