How do you track financial progress over your optometry career?

Whether you’re an associate or practice owner, you’re going to navigate a lot of financial decisions in your career. Job decisions, buying a house, investing, paying down debt, taking on more debt, cold-starting, partnership, and investing in your practice.

How do you track the impact of these decisions on your finances? Positively or negatively? Are they getting you closer to where you want to be? To your goals? To financial independence?

One important way to track progress is through your personal balance sheet. Your balance sheet tells you a lot about your finances and priorities. Here’s how I use your balance sheet to track financial progress.

What is a Balance Sheet and How Should You Review It?

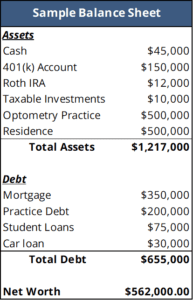

Your balance sheet lists your assets, debt, and your net worth (assets minus debt). It shows your financial position – your financial wealth – at a certain point in time.

You can learn a lot from constructing your personal balance sheet, like organization and clarity on what you own and what you owe. The first exercise I go through is building the balance sheet and reviewing the different assets, debts, and net worth. I want to check and diagnose financial health.

A few things I think about are:

- What’s the breakdown of different assets and debts? Is there a good mix of different types of investments? Or too heavy in one area?

- What’s the story behind each part? Why do you own certain assets? What’s the story of the different types of debt? I want to learn “why” and ask a lot of questions. The goal is to learn and discover. How do they relate to your values, goals, and priorities?

- Are there any initial points of concern? For example, is there higher interest debt we can plan around? Do you have way too much cash for your circumstances, or too little?

- Can we make improvements? For example, can you restructure debt or refinance for better terms? Are there retirement accounts that aren’t used to full potential? Do we need to put a system in place to manage and distribute cash in the optometry practice?

Net worth is an important barometer of financial progress. It’s one thing to earn a high income, it’s another to use that income to build wealth. The two major ways to build net worth are to save/invest and pay down debt. Both actions improve your balance sheet.

A common question that comes up is, should I invest or pay down debt? It might be your mortgage or student loans. It’s easy to focus on one variable – the debt itself, or the interest rate. Instead, take a step back and look at the larger picture. The better question is, what will have a more positive impact on your net worth over time?

You might want to cold-start a practice. This will require your balance sheet to look a certain way, as banks will prefer you to have cash in the bank and room in your cash flow instead of you aggressively paying down debt.

It’s also important to acknowledge that you very well may have a negative net worth, especially early in your career. Fresh out of school, student loans can loom large on the balance sheet. In fact, if you buy a house and a private practice, you can be $1 million in debt before you know it.

This is ok. Things will improve. What’s important is to start somewhere because progress will come. Be intentional about prioritizing your finances. Keep a careful eye on cash flow early in your career, and have a plan to invest and tackle the debt.

Now that you’ve analyzed your balance sheet for the first time, the next step is to track ongoing progress. After all, you’ll be taking action. You’re saving, investing, paying debt, changing jobs, starting businesses, taking more debt. Track how things change over time and make adjustments as you go.

I ask two questions as it relates to your balance sheet, and track ongoing progress for both:

- How much wealth do you need to make work optional?

- Do you have the right mix of assets?

How Much Wealth Do You Need to Make Work Optional?

When will you be financially independent? At what point is work optional?

The short answer – when you have enough assets and income sources to cover your living expenses. You need a high enough net worth to cover your lifestyle.

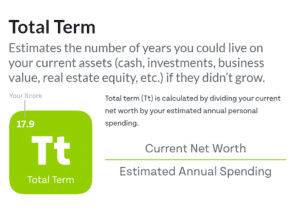

A simple way to benchmark this is by using a figure we call Total Term.

Source: Optometry Wealth Advisors – Our Approach. Elements is the system we use in our financial planning services.

Total term tells me how many years of spending your net worth can cover. That’s what allows work to be optional – you have assets to replace your earnings. A Total Term of 17.9 means your net worth can cover 17.9 year of spending.

What’s ideal? That depends on your own unique circumstances. Some families have a spouse with a pension covering a lot of their living expenses. Others rely on their investments. Ideally, Total Term is somewhere between 20 and 30.

We use a system to track this metric over time. Net worth takes time to build. It tends to move slowly at the beginning of your career and grows more quickly toward the end. Wealth compounds, and it takes time for that compounding to kick in. What’s important is taking action, building habits, and keeping an eye on progress.

Note: It’s common to use a big, fancy retirement projection to plan out the next 100 years of your life. Unless you are right at – or pretty darned close to – retirement, I don’t think those projections are super useful.

Yes, it’s cool to see how all the projected numbers turn out. But when retirement is so far away, it’s almost impossible to know what life will look like. Every variable in that projection will likely change. It’s inaccurate, and doesn’t help much to make decisions. Once you’re closer to that point, then it makes sense to pull out the big bad projection. The numbers are real and you can make some real decisions.

All that said, not all assets are created equal, which is why we also track….

Do You Have the Right Mix of Assets?

It’s important to track the growth of your net worth. It’s just as important to track the mix of assets you have. Not every asset is useful in retirement or can be used for income.

There are four categories of assets we track:

- Real Estate – your home, rental properties, practice real estate.

- Qualified assets – retirement accounts, like your 401(k), IRAs, cash balance plan. Anything that has a penalty for tapping early.

- Liquid assets – cash, taxable investment accounts. Anything you can tap or turn into cash quickly without penalty.

- Business – your private optometry practice or other private businesses you’re invested in.

Source: Optometry Wealth Advisors – Our Approach. Elements is the system we use in our financial planning services.

We track your current mix of assets and the growth of each category over time. The goal is to make sure you have the right balance and are taking advantage of the tax benefits available to you.

For example, you may have a net worth high enough to cover 30 years of spending. But if it’s all tied up in your house, it’s not very helpful to you. You’ll need to turn that home equity into liquidity that you can use to fund retirement. Rental properties would factor in differently because they can provide cash flow.

Another example is being too heavy on qualified/retirement assets. Yes, your retirement accounts provide a nice tax benefit that can really add up over decades. But, it’s also important to have liquidity in your life that you can tap into if needed. Sometimes tax benefits come 2nd to other priorities. “Don’t let the tax tail wag the dog,” as they say.

The mix of assets for optometrists follows a general trend over your career. Earlier in life, you’ll likely be heavier in real estate (your home) and in your practice. Over the years, you contribute to retirement accounts and taxable investment accounts. As you get closer to making work optional, all your investments will have had time to grow and compound.

Own a practice? You’ll likely exit your practice, turning business equity into liquid assets. So, qualified and liquid assets tend to weigh heavier later in life.

So what’s the right mix? That depends on each family’s personal situation and preferences. It makes a lot of sense to go into retirement with liquidity and be heavier in retirement and liquid assets.

Others have a focus on rental real estate and lean that way. Or choose to continue to own and manage the practice. What’s important is balance and having enough income and assets to cover your lifestyle.

Once you build your balance sheet, you can use it as a jumping off point for other areas of your financial planning.

For example, you can jump to estate planning. Review the titling of your assets (in trust, joint-tenants, community property?) and organize your beneficiaries. You can think about insurance, making sure you have an appropriate amount of umbrella insurance coverage.

So, have you put together your personal balance sheet? How do you review the health of it? How do you track progress?

If you’d like to see more educational articles drop directly do your inbox each week, subscribe below.

Any questions on how to check the health of your personal balance sheet? Let’s chat! Schedule a time to talk for a free consultation or shoot me an email at evon@optometrywealth.com.

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC