There’s a lot happening in our world right now. After a couple years of COVID, we’re turning our attention to war overseas as Russia invades Ukraine. And we see it all unfold in real time through the eyes of the internet and social media.

I can’t begin to put myself in the shoes of people at war. It doesn’t feel right to transition from human suffering overseas to personal finance. But as a financial advisor I’m asked – how do these things affect our finances?

The question quickly turns to our investments. How does all this affect your hard-earned invested money?

The start of the year has been a bumpy ride for the stock market. As of March 1st, the MSCI All-Cap World Index, a proxy for the global stock market, is down over 7% so far this year. The Russell 3000, a proxy for US stocks, is down around 9% year to date. Not massive drops, but still causing some concern.

With war, sanctions and everything else going on, there’s a lot of uncertainty. We don’t know how the markets will perform over the next week, month, or even the rest of the year.

So what should you do? How should you react? Should you change your investments? How does this affect your financial planning?

Here’s your guide to thinking through stock market declines and dramatic world events.

1. It’s Perfectly Normal to Be Nervous

It’s perfectly normal to be nervous during stock declines and uncertain times.

You’re human, after all. Investing means taking on some risk, and a bit worry is bound to follow.

What’s important are the decisions you make in light of those feelings. Take a step back and think through the situation rationally. As the saying goes, don’t make permanent decisions based on temporary emotions.

This serves as a reminder to make sure your asset allocation – the mix of stocks, bonds, and real estate – is appropriate for you long-term.

2. Stock Markets Have Seen Bad News Before

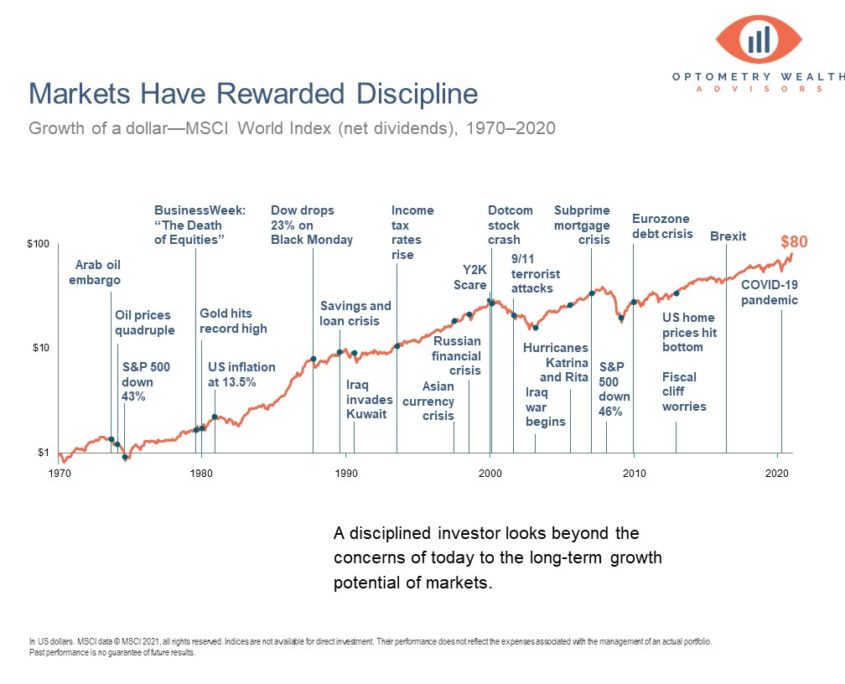

Ok, they haven’t seen this exact scenario before. But history has seen wars, disease, conflict, economic meltdowns, terrorist attacks, and panic. Terrible events and news are nothing new to this world or to stock markets.

Look at the chart above. The world stock market has seen plenty of bad news. From just 1970, investors have had plenty of reasons to panic and sell their investments. This doesn’t even include the Great Depression and two World Wars. Yet, despite all of that, the publicly traded businesses of the world keep plodding along.

Remember what you own in stocks – partial ownership in actual businesses. No matter the current events, the businesses of the world will do what they need to do to stay profitable and keep selling their goods and services.

Long-term investors can stay patient through scary times and take advantage of long-term stock market returns.

3. Declines Are a Normal (and Unpleasant) Part of Investing

We hate to experience it, but stock declines are a normal part of investing. It’s the expectation, not the exception. It’s something to endure, not to avoid.

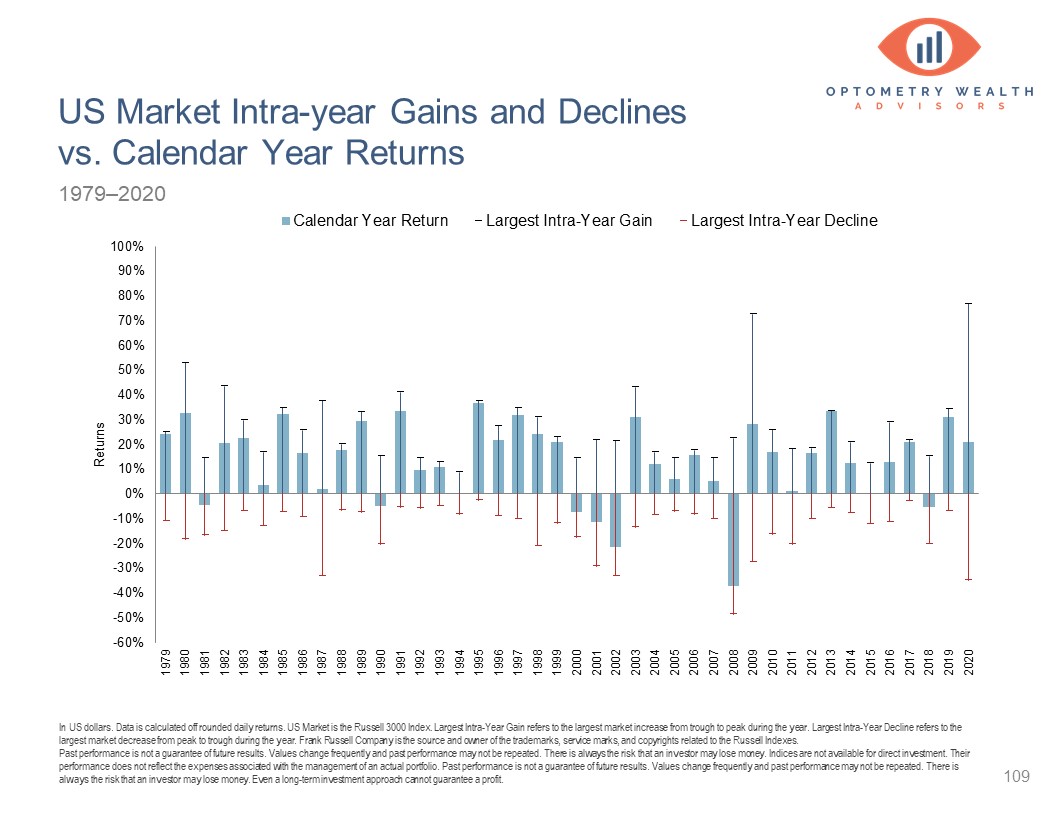

For example, look at the chart above for the Russell 3000 (US Stocks). It shows each year’s highest peak, biggest drop, and the end-of-year return.

From 1979 to 2020, US stocks had a positive rate of return 83% of the years. The average annual return was over 10%.

That sounds great, but it wasn’t all sunshine and rainbows. Within each of those years, there was an average decline of ~14%. Despide the dips, many years still end up with positive returns at the end of the year!

That’s the average, of course. Some years dropped by less than 14%, some by more. A decline of over 10% at some point in any given year is to be expected.

Risk is a part of investing. This is normal. Think of volatility (bounciness) as the short-term risk of volatility is the price you have to pay for long-term stock returns.

If you stay invested, you’ll see that…

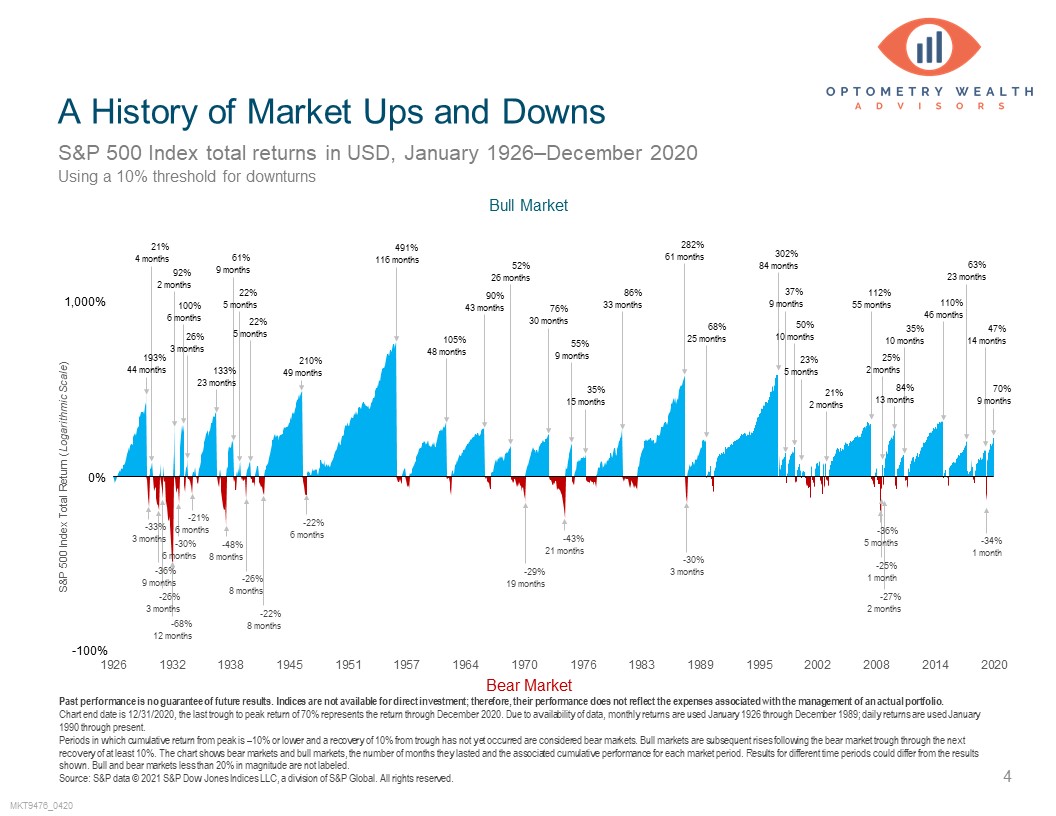

4. Stocks Tend to Recover After a Decline

Looking at the historical data for the S&P 500 – large US stocks – what happened after a 10% decline?

The average return afterward was 11.3% after 1 year, 10.2% after 3 years, and 9.6% after 5 years.

We never know how long a decline lasts, or exactly what the recovery looks like. But those who stick with it benefit from the recovery. You’re taking the risk, you might as well stick around for the reward.

5. Trying To Time the Market Can Have Big Consequences

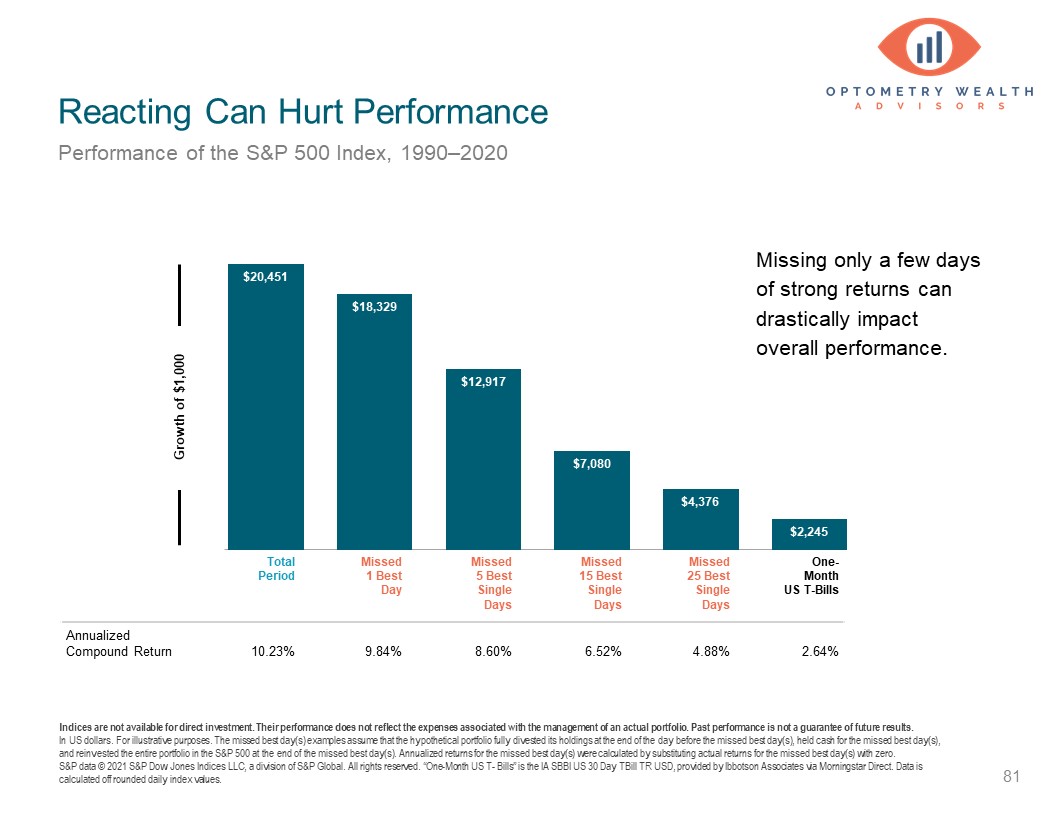

Avoid the temptation to act on the news.

“I’ll just sell now, wait it out, and get back in at the bottom,” you might say. But there are two decisions you have to make, and you need to be right on both – when to sell and when to buy back in.

Mistiming either decision can have a big impact on your returns – even if just a few days.

As we see above, the total return of the S&P 500 was 10.23% from 1990-2020. But, if you missed the one, single best day, it dropped your return to 9.8%. If you miss the 5 best days and the 15 best days, your return gets worse.

Finally, if you miss the 25 best days, your return is close to what you’d see in super short-term government bonds. You took all the risk and barely any of the reward.

We never know which are the “best” days. It’s incredibly hard, if not impossible, to make the right market timing decisions during volatile markets for a couple of reasons:

- Markets are pretty efficient and gobbling up all available information and incorporating it into prices. As soon as there’s new information, the thousands of investors quickly use it in buy and sell decisions and prices adjust accordingly. By the time we read about it, it’s too late.

- Markets are super volatile and sporadic during big declines, and emotions are at a high. The odds of making a mistake are picked up a few notches.

The 2020 COVID decline is still fresh in my memory. There were huge swings up and down every day. You never knew which day was the big recovery or another big decline. That amount of volatility can mess with your brain.

You never know which days are the “best” ones. If you’re hopping in and out, how confident are you that you’ll be invested when they come? A better approach is to try to tune out the noise and stay patient and invested.

6. Keep Your Time Horizon in Mind

Because short-term volatility is the price you pay for long-term expected returns, your time horizon is so important to keep in mind.

What is the goal for the money? How long will it be invested? How long until you actually need to use the funds?

You’re probably building wealth for long-term financial security. In that case, your time horizon is your lifetime. Financial independence (or retirement) may be decades away.

So how do short-term declines affect that long-term goal?

With a constant bombardment of news, it’s easy to be focused on the movement of markets day-to-day, month-to-month, or year-to-year. However, it’s helpful to zoom out, as if through a microscope switching to wider and wider lenses.

Source: DFA Returns

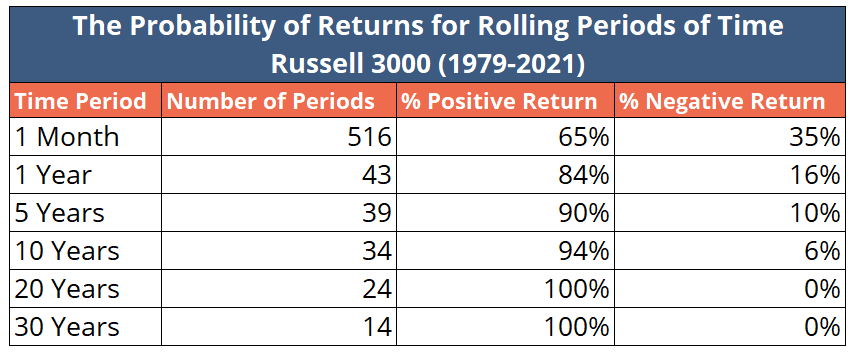

I looked at returns of US stocks from 1979-2021 over different chunks of time. What percentage of those periods – from one month to rolling 30 year periods – gave you a positive return vs a negative?

Short-term – month to month and year to year – there are plenty of times you’d see a negative return. But as you extend the time horizon – going out to 5 years and more – you’d have been more and more likely to see positive returns if you remained invested.

10 year periods had 94% probability of a positive return. What’s incredible is that there has never been a 20-year or more period in history that gave you a negative return.

What does this mean for us? Short-term periods are uncertain, and you should invest accordingly for short-term goals.

When you extend out the time horizon – especially over 10+ years – it’s more likely that you see positive investment returns. The risk of volatility phases out over time. The short-term drops become buying opportunities, as all the shares you want to own for decades go on sale.

Are those historical numbers guaranteed? Nope. But the odds are in your favor.

Conclusion: Focus on What You Can Control

History shows us that regardless of current events, the businesses of the world continue to do what they need to do to earn a profit and sell their products and services.

It’s tempting to take action. Patient, long-term investors that stay the course can enjoy the long-term returns markets provide.

Try to take a step back from the news and take a long-term perspective that matches how long you’re investing.

We can’t control the movement of the markets. Focus on the things that are within your control – this is where you have the biggest impact.

- Regular contributions – your regular deposits might be the most important variable in building wealth.

- Diversification – spread out your investments across all types of stocks, of all sizes, all over the globe. Have an appropriate mix that matches your goals and time horizon.

- Rebalancing as needed – you likely have a certain asset allocation. This is a mix of different stocks, real estate, and bonds with specific percentages allotted to each. Certain categories of investments will naturally increase higher than your preferred percentages. You can sell those categories, trim them back to where you want, and use the funds to buy the categories that are too low. This is systematically selling high and buying low.

- Taxes and expenses – review the tax efficiency and the expenses of your investments. Costs can have a big effect on your returns over time.

Focus on what you control, and have an investment process that you can stick with through the ups and downs. Of course, don’t take my word for it. Due your due diligence, and talk with your financial advisor to make sure your investing approach is right for you.

If you’d like to see these educational articles drop directly do your inbox each week, subscribe below.

Want to make sure your investment approach is on the right track? Let’s chat! Schedule a time to talk or email me at evon@optometrywealth.com.

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC