How do income taxes work? How do tax rates work? How are your taxes calculated?

As tax filing deadlines approach, Evon dives into a basic guide for optometrists to how US federal income taxes work.

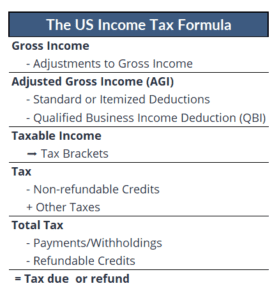

He dives into how marginal tax rates work, how taxes are calculated, withholdings and estimated tax payments, filing deadlines, and different tax planning concepts to keep in mind when making financial decisions.

Have questions on anything discussed or want to have topics or questions featured on the show? Send Evon an email at evon@optometrywealth.com.

Check out www.optometrywealth.com to get to know more about Evon, his financial planning firm Optometry Wealth Advisors, and how he helps optometrists nationwide. From there, you can schedule a short Intro call to share what’s on your mind and learn how Evon helps ODs master their cash flow and debt, build their net worth, and plan purposefully around their money and their practices.

Resources mentioned on this episode:

- The Optometry Money Podcast Ep. 34: 5 Levers to Control Capital Gains on Your Tax Return

- IRS Withholding Estimator

- The Optometry Money Podcast Ep. 37: Tax Planning for Charitable Giving

- Eyes on the Money Newsletter #33: Tax Levers Before Tax Time

The Optometry Money Podcast is dedicated to helping optometrists make better decisions around their money, careers, and practices. The show is hosted by Evon Mendrin, CFP®, CSLP®, owner of Optometry Wealth Advisors, a financial planning firm just for optometrists nationwide.

Subscribe to our podcast below!

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC