Cash flow is king. It’s the lifeblood of your optometry practice and your household.

Healthy cash flow helps you navigate tough times and take advantage of opportunities. When it’s not healthy, it can lead to a struggling practice and more stress than you want to deal with.

You felt how important this was over the last two years as COVID shut down practices for a few months. You saw a level of uncertainty you probably never saw before.

The optometry practices that prospered – and the owners that stressed the least – were profitable businesses that mastered their cash flow. They weathered the downturn and took advantage of opportunities as things recovered.

As important as it is, cash flow can be one of the least understood parts of optometric practices. After income comes in and business expenses are paid, you have to decide…

What do I do with what’s left?

Should I make an owner distribution? Or keep money in the business?

What do I do about taxes?

Can I invest in new equipment or in the office?

What you need is a good system to know where cash comes from, where it goes, and what to do with it. A consistent process can give you a better grip on your business and cut the guesswork.

You need a system like the Four Forces of Cash Flow.

The Four Forces of Optometry Practice Cash Flow

In their fantastic guide on small-business finances, Simple Numbers, Straight Talk, Big Profits: 4 Keys to Unlock Your Business Potential, Greg Crabtree and Beverly Blair Harzog give a fantastic framework on how to handle operating profit in your business.

After covering core business expenses, four forces demand cash from your business. In this specific order:

- Taxes

- Debt

- Core Capital Target (cash reserves)

- Owner Distributions

There are three entities that you need to pay before you (the shareholder) can pay yourself – the government, the lender, and the optometry practice itself.

You need to set aside money for taxes, make the debt payments, and make sure there’s enough cash to fund your cash reserve and any potential investment. Then you have the freedom to make distributions with the funds available.

This framework can give you a path for how to track and handle net cash flow in the business and decide whether owner distributions make sense.

The Four Forces in Practice

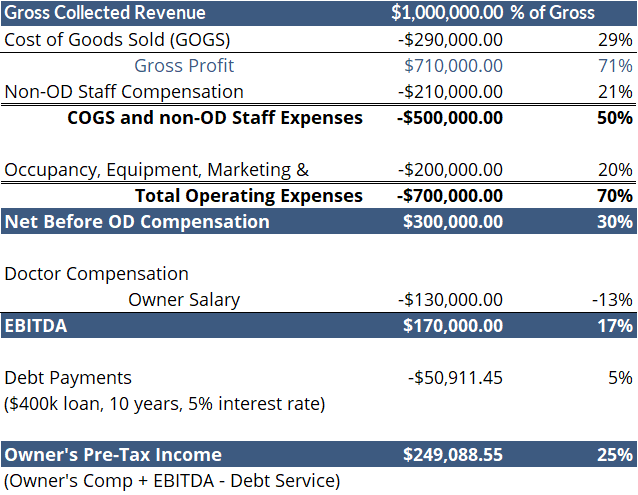

Here’s how it might look like in a sample practice, a solo-OD practice collecting $1 mil of gross revenues in the year:

The net cash flow from operations (measured by EBITDA) was $170k, and after debt payments the owner had a very nice $249,088 available before taxes.

So, you and your team do all you can to collect revenue and make sure your operating expenses and compensation are where they should be.

Now the question is, what do you do with that net cash flow? Take it all out as an owner distribution? Sock it all away in savings? Buy that fancy new All-in-One visual acuity system?

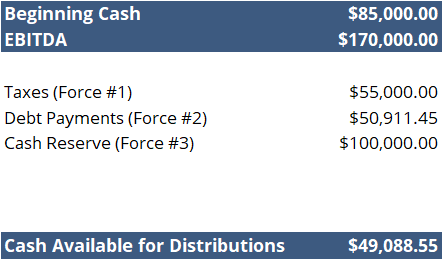

Let’s assume you started the year with $85,000 in cash savings. You needed to set aside $55,000 for estimated tax payments, and you set your cash reserve level at $100,000. The Four Forces might look like….

With all other mouths fed, you know your business has $49,088 to distribute at the end of the year to you as the shareholder.

You can gauge the amount of cash available and have the confidence and clarity to make the right decision.

A Plan for Action With Your Optometry Practice Cash

A simple way to use this framework is on a quarterly schedule.

1. Each month, look at the available cash after collecting revenue and paying for business operating expenses.

2. Then, set aside funds monthly for taxes. Put this in a separate bank account – out of sight and out of mind – until it’s time to send them in. It’s no longer your money, and you don’t want to be tempted to use it in the business.

How much? You want to at least set aside enough to avoid paying an underpayment penalty at tax time. The IRS gives us two approaches with federal taxes to avoid penalties – based on last year’s income or this year’s.

If you withhold 100% of last year’s total tax (110% if you earned $150,000+ AGI, $75k+ if married filing single) or 90% of this year’s total tax, you avoid an under-withholding penalty.

In an ideal world, you’ve withheld exactly the amount you owe and show a $0 due at tax time. You can adjust through the year if your income jumps up or down.

Keep in mind this is for your household tax return. The important number is total household tax withholdings at the end of the year.

This can be a combination of salary withholdings (if you own an S-corp or spouse has employment income) and quarterly estimated payments.

Work with your tax professional and/or your financial advisor to project taxes and take the right approach. Keep in touch a couple times each year to adjust as income fluctuates.

You can also use the IRS’s Tax Withholding Estimator to estimate an amount.

3. Make your monthly debt payments.

4. Check cash reserves and make sure there’s a reserve level you’re comfortable with.

This is ideally something you’ve put a number to – for example, one month’s expenses plus another month’s available in a line of credit. Or, look back at the largest dip in your practice’s cash. Your CPA or consultant should have a feel for what works best for your practice.

This helps when cash flow swings below your collected revenue temporarily or anything else that comes up out of the blue. It’s the emergency and opportunity fund for your business.

5. Lastly, you have an amount you can confidently distribute to the owners. Is there an investment you can make in the practice with a solid ROI? If not, get the funds out of the business.

You can do this on a quarterly basis, semi-annually, or any cadence that makes sense for your business.

Use the distributions to increase your net worth outside the business by either paying down debt or investing.

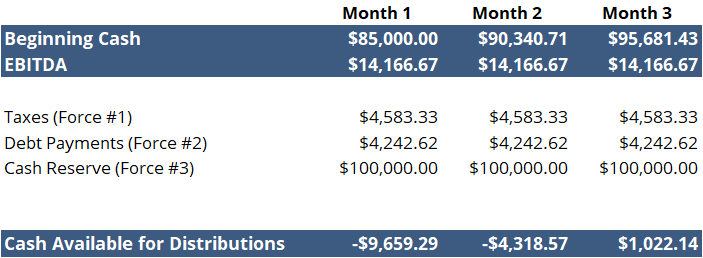

Using the sample practice above, this cadence might look like:

In the example above, there wasn’t enough cash to meet the reserve in the first two months. But, in month three, you filled all four buckets. You have a bit of cash for distribution.

If the cash level drops below the reserve amount in the future, you simply hold off distributions off until there’s enough cash.

A final note on household finances

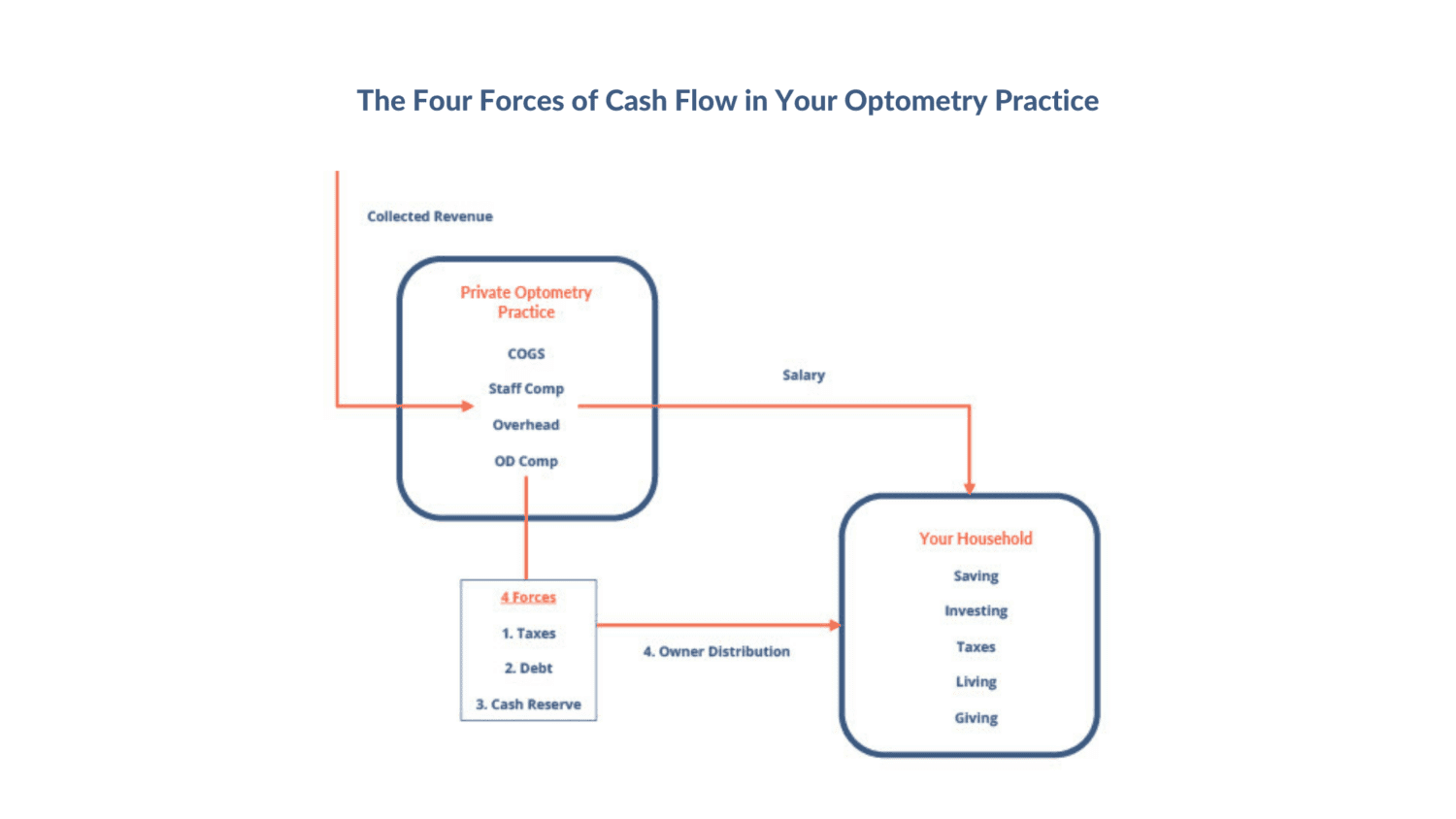

Business and household finances are so closely intertwined, as the business is the driver of household financial health. From a planning standpoint, I take an integrated approach – focusing on the health of both the practice and household finances.

But, it’s important to remember the practice and the household are two separate machines. Totally separate entities. Each machine needs to use its financial gasoline efficiently.

It’s important to make sure you’ve created some stability and a cash savings in the household to take pressure off the business when things are tight.

Pay yourself a reasonable, market-based wage for the work you do in your business as a practitioner and manager. Fit your personal spending within this salary and don’t rely on owner distributions. This will give your business breathing room when cash flow is tight and can help you think more strategically as an owner about how to use your practice’s profit.

If you’re an S-corp owner, it’s an actual salary. Members of LLC taxed as a sole proprietor may just take distributions.

Have a solid emergency fund in your personal bank account. How much? Generally, two-income households can work with 3-6 months of necessary expenses. A single-income household – especially a practice owner – might consider between 6-12 months’ expenses.

The larger cash reserve in the household can lower stress when the business is struggling. It helps you avoid needing to draw from the business during rough patches and allows the business to focus on covering practice expenses.

Any framework like the Four Forces of Cash Flow can help you have confidence to decide how you should use your optometry practice cash flow. Use a system that makes sense to you and you can stick with. Having a better grip on cash flow can leave you better prepared for whatever the future holds.

Any questions? Schedule a time to chat with me for a free consultation or email me at evon@optometrywealth.com.

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC

Optometry Wealth Advisors

Optometry Wealth Advisors