Why Optometry Practice Owners Should Pay Themselves a Market-Based Wage

Optometry private practices can be phenomenal cash-flowing businesses. Owners can put that steady cash flow to work in building their inside and outside the practice.

Many optometry practices are taxed as s-corporations. There’s a lot to consider when deciding what structure of a business entity to use, and one of the biggest reasons to be an S-corp is to save taxes.

This can also lead to a big mistake many owners make – not paying themselves a reasonable, market-based wage. I lay out 5 reasons practice owners should avoid this temptation and pay themselves a reasonable wage.

How an S-Corporation works

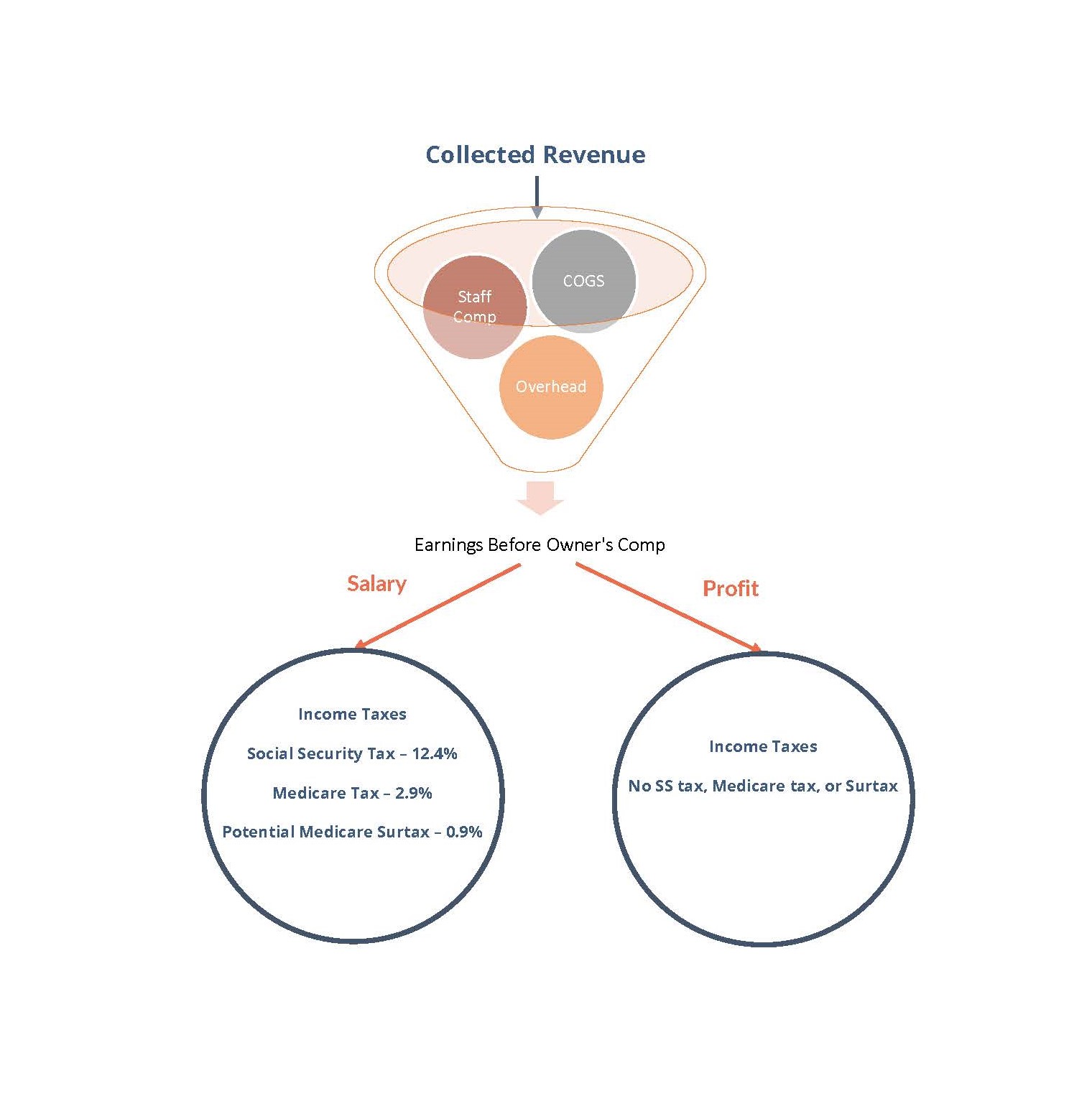

S-corporations are pass-through business entities. They don’t pay their own taxes at the corporate level, instead passing on all income to land on the owner’s tax return. As a shareholder, you are both an employee and an employer. You’re required to pay yourself a “reasonable” salary for the work you do in the business. When you have profit above that, you can take owner distributions as the shareholder.

You get paid a salary for what you do and a return on what you own.

The tax benefit? You’re required to pay FICA employment taxes on your salary. Employees pay half, and the business pays half. As the owner, you’re responsible for both portions on your own salary. That’s a total of 12.4% Social Security tax up to $147,000 of income (in 2022), 2.9% Medicare tax, and a 0.9% Medicare surtax for income over $200,000 ($250,000 for married taxpayers).

However, you don’t have to pay FICA taxes on profits of the business.

So if your gross income is $1,000,000, and your salary was $150,000 and profit distributions were $150,000, you saved $22,950 on FICA taxes on your profits.

While that’s only one variable in the S-corp decision, having a combined 15.3% on your profit isn’t too shabby. This makes it tempting to pay yourself a super low salary and take the bulk of your practice’s net income as profit distributions.

Don’t give in to this temptation! Let’s go over 5 reasons to pay yourself a reasonable, market-based wage for your work in the practice.

1. Predictable income to support your personal lifestyle.

Pay yourself an appropriate salary high enough to support your monthly living expenses without relying on taking profits. This can take pressure off of the business. If you cover your personal saving and spending goals each month with a steady salary, you give yourself flexibility as a shareholder to make good decisions with the profits of the practice.

You won’t be tempted to lean on owner distributions to fund your spending. Instead, when needed, you can choose to keep the profits in the practice for cash savings or reinvestment. When business cash flow is tight, you can wait on distributions, knowing you’re able to handle your personal expenses.

This requires some personal financial planning – fitting your personal lifestyle within the salary, and not letting lifestyle creep eat up every dollar of income the practice can generate.

You can also handle tax withholdings through your salary, taking pressure off of quarterly estimated tax payments.

2. Accurately show the financial performance of your optometry practice

You wear two distinct hats in your practice – the practitioner and the shareholder. Each hat requires a very different mindset with different duties. The practicing optometrist focuses on patient care, and the shareholder focuses on the management and growth of the business.

Your salary as an OD is a real expense for the business. Yes, it’s you just paying yourself, but it’s an expense that exists whether you’re the doctor or if you had to hire another.

As Greg Crabtree writes in his book Simple Numbers, Straight Talk, Big Profits, “…entrepreneurs often misunderstand the relationship between their salary and the return on what they own… Why is this so important? Because when you don’t pay yourself a market-based wage, your net income number is lying to you.”

Paying yourself too low a salary can make your practice look more profitable than it really is. No surprise – you’ve lowered your OD salary expense, and pumped up the net profit. This can distort the numbers.

Imagine you stopped working as a practicing OD and hired someone to take your place. You’re now looking at your business as only the shareholder. How would you look at this situation? Wouldn’t you want accurate numbers telling you about the accurate performance of the business?

Great decisions, accurate forecasting, and useful benchmarking can only be done if the information you’re looking at gives you the accurate story of the business.

Put yourself in the shoes of a potential buyer – would a buyer have an accurate picture of profitability? Murky numbers are why you might see add-backs and adjustments and earnings before owner’s compensation (EBOC) used as a benchmark instead of straight profitability.

3. Lower or loss of benefits based on wages

Several important government benefits are calculated based on your wages. They can be limited if you don’t set your salary high enough.

Social Security is based on your lifetime wages, up to a cap each year. Despite sometimes negative press about social security, it’s still a pretty darned good annuity for retirees. It gives a consistent income that increases over time with inflation and provides continuation for your spouse. It makes sense to take full advantage of this benefit, and maybe set your salary at least up to the Social Security wage base each year.

State unemployment and disability benefits may be limited, depending on how much you’ve paid in and your declared wages. Though we’ve seen UE benefits open up to the self-employed during the pandemic.

The COVID pandemic gave us a great example of potential lost opportunity. The amount of Paycheck Protection Program (PPP) loans practices received was based on the wages of employees – including the S-corp owner – up to $100,000 of income. Pay yourself less than a $100,000 salary? You saw your loan amount limited.

4. Potentially lower use of retirement plans

Lower wages may lead to a lower amount you can put into your retirement accounts through the practice.

Profit-sharing plans, for example, are usually calculated with a formula based on employee wages. Lowe wages can also affect cash balance plans.

5. It’s an IRS Red Flag

Lastly, and maybe most importantly, this IRS doesn’t like this.

It’s a “red flag” for audits. As the IRS says on it’s website, “S corporations must pay reasonable compensation to a shareholder-employee in return for services that the employee provides to the corporation before non-wage distributions may be made to the shareholder-employee.”

If caught red handed, the IRS has the authority to reclassify owner distributions into salary and will kindly ask for necessary taxes, interest, and penalties.

You don’t want to get on the bad side of the IRS. Keep your salary “reasonable” and stay on the straight and narrow.

And that’s not to mention the state and local governments that have their own wage-based taxes!

What is a reasonable S-Corporation Salary?

The big question is, what’s a “reasonable”, market-based salary?

Think through what you personally do in the business that helps generate income, vs. what’s done by employees or capital and equipment. What would you have to reasonably pay someone else to do everything you do in the practice?

This is where you should lean on your CPA or Enrolled Agent for guidance. There are OD salary benchmarks, but it can get a little more complicated because you’re likely doing more than just seeing patients. You have management and administrative duties too.

Some tax pros will take a blended approach and separate out how much of your time is spent in each role. For example, if you split time in the practice 70% seeing patients and 30% administrative/management work, you might calculate a salary of:

| Role | Salary for Role | Time Spent | Blended Salary |

| Optometrist | $140,000 | 70% | $98,000 |

| Management | $80,000 | 30% | $24,000 |

| Total Salary | $122,000 | ||

The IRS gives some guidance about this. Some factors to determine reasonable compensation are:

- Training and experience

- Duties and responsibilities

- Time and effort devoted to the business

- Dividend history

- Payments to non-shareholder employees

- Timing and manner of paying bonuses to key people

- What comparable businesses pay for similar services

- Compensation agreements

- The use of a formula to determine compensation

It’s pretty broad and probably intentionally so. Work closely with your tax professional to get a salary that works for your business.

Conclusions: Keep it Real

Let’s keep it real. Pay yourself a reasonable salary based on a market wage for what you do in the business.

It helps to keep consistency with household cash flow, take pressure off the business profits, keep an accurate accounting of what’s going on in the business, and keeps you in line with government rules.

Always remember to step back and look at your optometry practice wearing the hat of a business owner. You want to have as accurate information as possible to make the best decisions possible.

Greg Crabtree gives you two challenges as a business owner:

- Be a more demanding employee

- Be a demanding shareholder

Let’s take on these challenges for the betterment of your financial planning and the health of your practice.

Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC Optometry Wealth Advisors LLC

Optometry Wealth Advisors LLC