Optometry-Specific Financial Coaching

You want financial guidance from someone who understands where you’re at and where you’re going.

We’re CFP®s for optometrists. All of our time and resources go into learning about and serving you in your careers and practices.

We’re a fee-only financial planning firm. We don’t sell any products and earn no commission. There’s no slinging whole life insurance here.

This means we’re able to limit the conflicts of interest we face when advising families. We can objectively provide financial advice in your best interest.

We also don’t take assets under management fees. Instead, our services are a flat fee, billed monthly. We see this as another step in lowering conflicts and aligning our services to your needs.

Continuous Tracking of Financial Progress

We have a system that proactively tracks the changes and progress in key financial health metrics:

- Net worth

- Breakdown of different debts and assets

- Savings rate

- Debt rate

- Spending rate

- Liquidity

- And more!

This helps us to track your progress toward goals and be proactive in solving financial issues and making decisions. You have your own dashboard to follow along and collaborate with us.

Click here to learn more about our modern approach to financial planning.

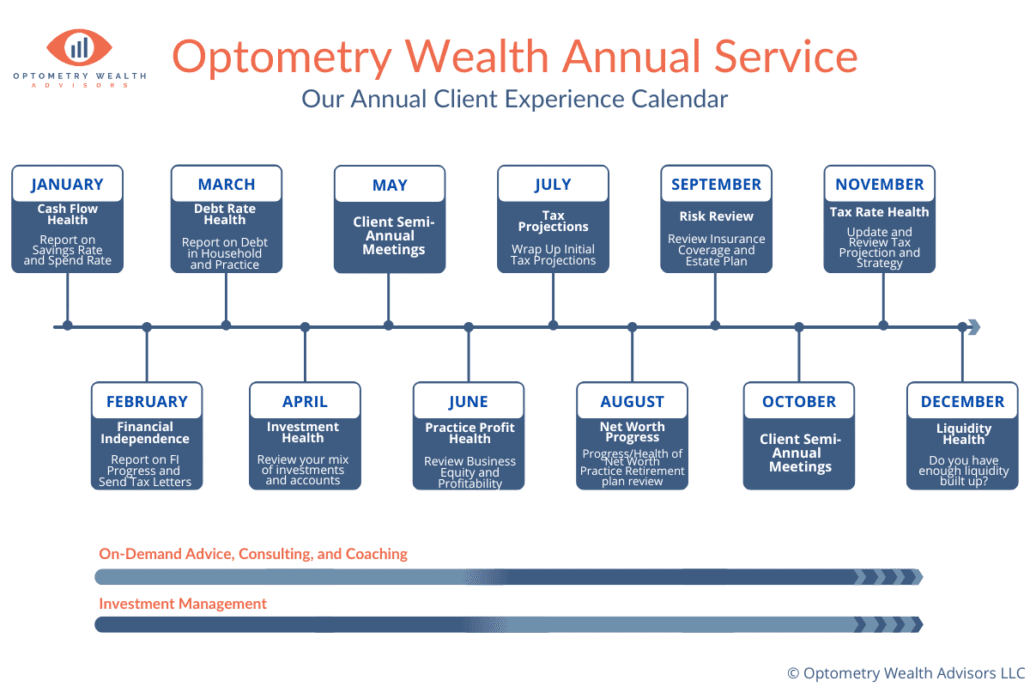

Quarterly Progress Reports and Financial Reviews

Imagine if you could track the eye pressure, acuity, or other vitals in the eyes of your patients. What proactive conversations could that create? What would you catch ahead of time?

We take the same approach to monitoring the health of your finances over time.

We provide quarterly reporting on the progress of your net worth. We also provide monthly reviews on each aspect of your financial life – from insurance to taxes, savings rate to liquidity. Proactive review of each area of your finances ensures nothing slips through the cracks, issues are caught ahead of time, and we make great financial decisions as your life changes.

Check out the Our Approach page for more about the key financial health metrics we track through the year.

Student Loan Analysis

Student Loans are a part of every optometrist’s life, and require a different approach than traditional debt planning.

Which approach to paying down the debt is right for you – in light of your personal and career goals? In light of your cash flow needs – buying a house, getting into practice ownership, the desire to invest?

We provide a student loan analysis as a part of our ongoing services, crafting a payment plan that’s right for you.

We also provide student loan analyses as a standalone service.

Tax Planning

Almost every financial decision affects your taxes. We work with you to project, plan, and limit the amount of taxes you pay over your lifetime. This includes gathering and reviewing your tax return each year. We coordinate and work closely with your CPA/EA so your professional team is on the same page.

Tax planning is a lifelong endeavor. Rather than focus only on a single tax year, we work to make sure your wealth grows as tax-efficiently over your lifetime. Some years this means deferring taxes through deductions, other years it means taxing income today. We work together to make sure you make the right decisions for your circumstances. Let’s work to pay the least amount of taxes possible without leaving the IRS a tip.

Master Your Cash Flow and Debts

We work together to get clarity and confidence around your cash flow. Maybe you’re thinking through a big purchase, like buying a house or purchasing into a private optometry practice. Maybe you want a better grasp on the cash flow in your practice. How do you review and manage what’s coming in and going out?

A big part of cash flow is properly managing debt. At some point in your optometry career, you’ll run into debt decisions, whether it’s practice debt, your mortgage, or student loans. Sometimes this means restructuring your debt to improve cash flow or lower your interest. Other times, it means paying it down aggressively. Whatever the scenario, we help you model out and make the right decisions for your life

Insurance Planning

Some financial risks can have a major impact on your life. These are risks that are worth insuring.

We work together to make sure you have the proper amounts and types of insurance. We’ll review each policy you have at least once per year to make sure you’re properly covered. This includes life and disability insurance, group benefits, and more. We coordinate with qualified insurance agents to help you make the right purchases at the right time.

Investment Management

We help the families we serve invest using a long-term approach based on decades of academic research.

We take a “passive” approach to investment management, building portfolios using low-cost, globally diversified, and tax-efficient mutual funds and exchange-traded funds (ETFs). Investment management can’t be separated from the financial planning process – you have goals for your wealth and your life, and the investments need to align with them.

We spend time to help you decide on the right mix of stocks, bonds, and real estate. You should take the appropriate amount of risk and return for your specific goals and circumstances. Then, we provide ongoing monitoring and management of your investments. We coordinate all of your accounts for each particular goal – even workplace retirement accounts – into one aligned portfolio toward that goal.

We lead with education, and work to educate you as much as you’re interested in about investing, our philosophy, and how we manage accounts, and what your specific plan is during times of volatility.

Estate Planning

What are your ultimate goals for your wealth? What would you want to happen in the event of death or disability? Who would you want to look after your kids if something happened? What happens with your optometry practice?

These are some of the most important questions to answer in your estate planning. We review your estate plan with you, talk through your wishes, and coordinate with an estate planning attorney to make sure there’s a plan in place. We review everything over time to account for changes in your life and your wishes.

This includes reviewing your estate planning documents (living trusts, wills, powers of attorney, business operating agreements), insurance coverages, and beneficiaries on at least an annual basis. We also document and diagram your estate plan to make it digestible and understandable for you and your heirs.

Tax-Advantaged Charitable Giving

There are many ways to donate funds to charity – some are more tax-advantaged than others. This may be bunching donations into a single year for higher deduction. Or, donating appreciated investments instead of cash. We want to make sure you’re doing the charitable giving on your heart in the most tax-efficient way possible.

Practice Financials Review

Your practice is your most important asset. It provides financial stability today by paying the bills and the cash flow you need to build wealth for tomorrow. We want to help you understand the financials of your optometric practice. Clarity around the financial health of your practice brings the ability to make better business decisions.

Ultimately, the financial health of your practice impacts the health of the household. But it’s not all about the finances. We also want to help you ensure you’re building the ideal business for your ideal life. Are you spending the time you want in, on, and outside the practice? Is your practice running you, or are you running your practice?

I take an integrated approach, making sure we plan purposefully around both important parts of your life.

Retirement Planning

Building toward financial independence is a lifelong practice, involving a lot of different variables – investments, lifestyle spending, your investment contributions, mix of assets, personal goals, and many more. We help you make work optional by tracking your retirement “readiness” over time. When the time comes, we help you sustainably turn your net worth into income in the most tax-efficient way we can.

We also make sure you’re building the right types of assets over your career to match your idea of “work optional”. We want to make sure you have the right mix of retirement accounts, business assets, liquid investments, and real estate for your retirement goals and tax planning.

If you’re a practice owner, we want to make sure you’re taking advantage of the right types of retirement accounts over your career.

We believe financial planning is an ongoing process, not a one-time event.

Your life changes, finances shift, and goals change. We’re here to guide you at every step.

We proactively monitor the health of your finances throughout the year, reviewing a key topic each month.

Learn more about our process and approach.

OUR PRICING

Financial planning and investment management for a flat, monthly fee.

No investment fees. No Asset minimums.